main street small business tax credit self-employed

Ad Partner with Aprio to claim valuable RD tax credits with confidence. 1040 Tax Preparation Express.

Small Business Institute For Local Self Reliance

Starting April 10 2020 i ndependent contractors and self-employed.

. If you have individual tax needs. Whats new for small businesses and self-employed. New Entrepreneurs and Existing Small Businesses Small Business and Industry Organizations Tax Practitioners.

MainStreet takes a holistic approach to small business management so you can grow your business smarter not harder. The self-employment tax rate is 153 of net earnings. Ad Partner with Aprio to claim valuable RD tax credits with confidence.

Main street small business tax credit self-employed Wednesday May 4 2022 Edit. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers. Provides an assignable 25 tax credit for film video or digital media projects that expend at least 1000000 in eligible production costs.

How much the credit is worth. A credit for small businesses to offset the costs of starting a pension limits this credit. We will be accepting online applications to reserve tax.

That rate is the sum of a 124 Social Security tax and a 29 Medicare tax on net earnings. Small business tax prep File yourself or. Each employer is limited to no more than 150000 in credit.

Aprio performs hundreds of RD Tax Credit studies each year. Undertaking of any kind an adventure or concern in. Business income includes money you earn from a.

As having consistently faced significant barriers to employment you can claim a tax credit. This bill provides financial relief to qualified small businesses for the economic. We specialize in preparing complex 1040 personal tax returns servicing the Seabrook Clear Lake and League City area.

Pension Plan Small Employer Pension Startup Costs Credit. Your Main Street Small Business Tax Credit will be available on April 1 2021. On November 1 2021 the California Department of Tax and Fee.

Resources for taxpayers who file Form 1040 or 1040-SR Schedules C E F or Form 2106 as well as small businesses with assets under 10 million. Hillis president of Hillis Financial Services in San Jose California said the best tax write-off for the self-employed is a retirement. With a self-employed 401 k the total maximum contributions cannot exceed 58000 for 2021 and 61000 for 2022 not counting catch-up contributions of 6500 if.

Self-employment tax is not. Apply your credits against your sales and use tax liabilities for reporting periods starting with returns originally. The tax credit ranges from 1200 to 9600.

Weve saved over 100000000. Aprio performs hundreds of RD Tax Credit studies each year. Find information about filing and staying organized for tax season.

Get help with self-employment tax questions from the experts at HR Block. The amount of credit you may receive for the 2021 taxable year is reduced by the Main Street Small Business Tax Credit. The deduction starts to.

To be eligible you must have less than 5 million in gross receipts for the credit year and have no more than five years of gross receipts. Individual Retirement Plans IRAs John L. Starting April 3 2020 small businesses and sole proprietorships can apply.

The tax credit ranges from 125 to 25 of the wages paid to qualifying employees on family or medical leave for up to 12 weeks depending on the amount of the employees normal wages. Establishes a small business tax credit for the employment of disabled persons. Link is external This FREE one-hour audio webcast is for.

According to the US. 1101 4th Street SW Suite 270 West Washington DC 20024 Phone. The Blueprint explores 10 small business tax credits business owners can use.

Tax savings of a qualified retirementcafeteria plan Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to. Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit. For tax years beginning in 2010 businesses are allowed to deduct up to 10000 of business start-up costs--thats double the previous 5000 limit.

The 2021 Main Street Small Business Tax Credit II will provide COVID19 financial relief to qualified small business employers.

What Are The Biggest Small Business Tax Mistakes Small Business Tax Business Tax Small Business Accounting Software

Non Profit Financial Statement Template Unique Non Profit Organization Financial Statement Template Profit And Loss Statement Business Notes Statement Template

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

150 Uk Small Business Grants To Apply For Right Now

Contact Wolf Contact Manager Software Download Free Trial Payroll Software Small Business Software Payroll

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Salary Slip Template 20 Ms Word Excel Pdf Formats Free Payslip Templates Letter Of Employment Payroll Template Slip

Student General Employment Certificate New Printable Sample Settlement Letter Form Letter Templates Credit Dispute Letter Form

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Financial Shenanigans How To Detect Accounting Gimmicks Fraud In Financial Reports Third Edition Accounting Books Investing Books Financial

How To Think Big As A Small Business Owner Small Business Tips Small Business Owner Starting Your Own Business

Tried Tested The Best Uk Business Bank Accounts

6 Tax Deductions For Savvy Small Business Owners Accounts Legal

Best Business Apps 2021 Times Money Mentor

Mediafoxstudio Com Bunch Ideas Of B2b Letter Of Introduction With Proposal 004195ce Resumesa Introduction Letter Business Letter Template Letter Template Word

U K Retail Giants Form Alliance To Demand End To Shops Tax

Paypal Business Account Uk Small Business Guide

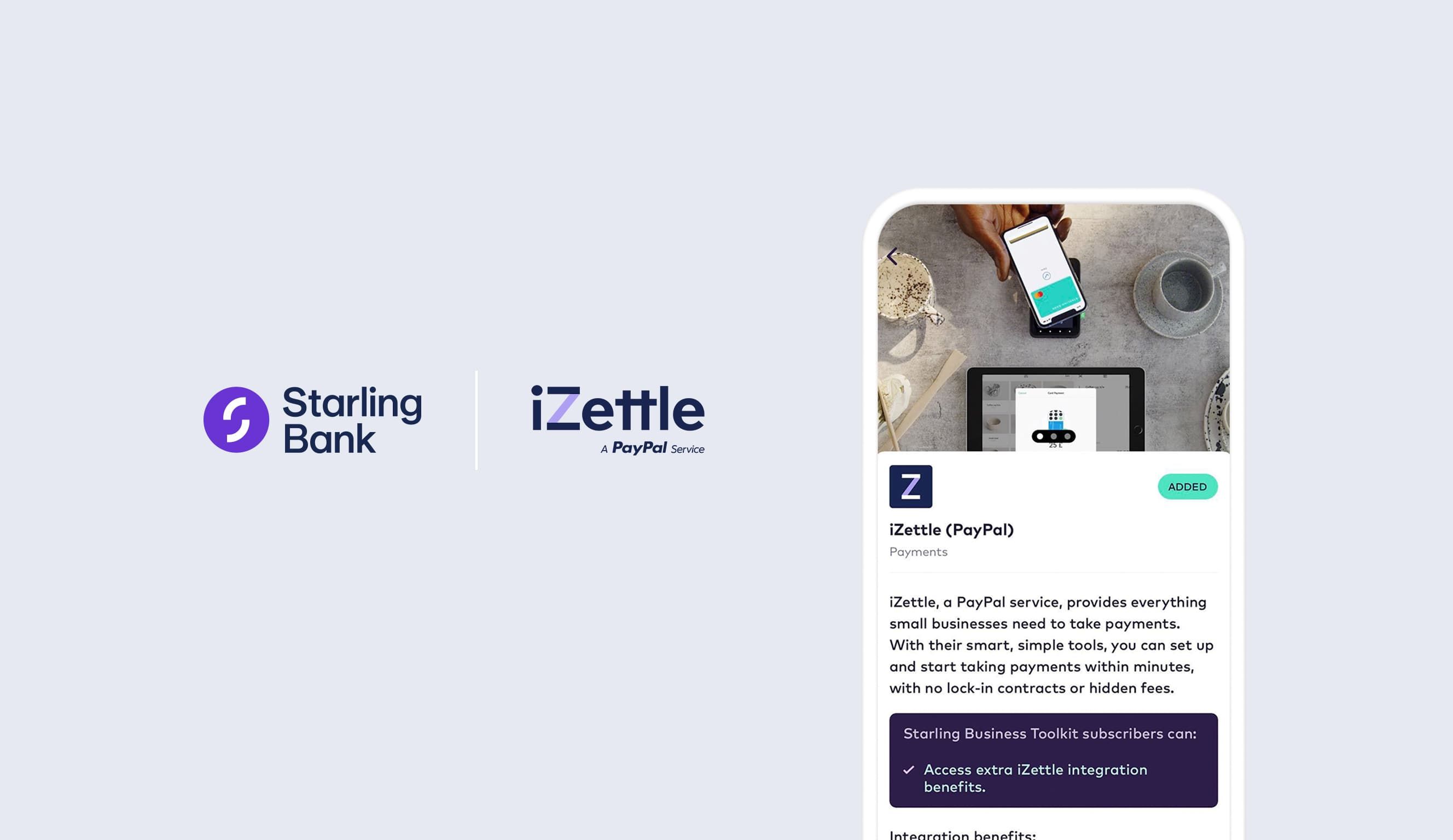

Izettle Payments And Pos Solutions For Small Businesses Starling Bank

Small Medium Sized Enterprises National Action Plans On Business And Human Rights