south dakota property tax records

Pay an average of 103 of their housing. About Assessor and Property Tax Records in South Dakota.

Equalization Pennington County South Dakota

South Dakota real and personal property tax records are managed by the County Assessor office in each county.

. Please send us your check and the tear stubs from the bottom of your Official Tax notices to the Codington County Treasurers Office 14 1st Ave SE Watertown. Tax amount varies by county. You can look up current Property Tax Statements online.

Click here for any questions about tax. Select your address as it appears below the. Spink County Government Redfield SD 57469.

Counties in South Dakota collect an average of. If you are a senior citizen or disabled citizen property tax relief applications are available through our. The second half of property tax.

Please click HERE to go to payview your property taxes. Everything you need to know about games licensing and beneficiaries of the South Dakota Lottery. Any person may review the property assessment of any property in South Dakota.

To look up property tax records in South Dakota youll need to contact the county assessors office in the county where the property is located. Any person may review the property assessment of any property in South Dakota. Property assessments are public information.

The South Dakota Property Tax Portal is the one stop shop for property tax information resources and laws. Go to the Property Information Search. Across South Dakota the effective annual property tax rate stands at 114 the 17th highest among states.

Learn what you need to file pay and find information on taxes for the general public. Taxes in South Dakota are due and payable the first of January however the first half of property tax payments are accepted until April 30 without penalty. South Dakota Registry of Deeds Offices The.

The Pennington County Equalization Department maintains an. Public Property Records provide information on land homes and commercial properties. ViewPay Property Taxes Online.

Use our free South Dakota property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent. Pay your property taxes by mail. Spink County Redfield South Dakota.

This system features the Property Tax Explainer Tool that provides a high level. Property assessments are public information. In the year 2023 property owners will be paying 2022 real estate taxes Real estate tax notices are mailed to.

In maintaining ownership records the assessor defines the boundaries of land according to ownership and assigns a unique identifying number to each parcel. A South Dakota Property Records Search locates real estate documents related to property in SD. The Pennington County Equalization Department maintains an.

Yankton County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Yankton County South Dakota. Please allow 7-10 business days to process if paying online. Enter only your house number.

This is referred to as the. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. For context homeowners in the US.

Real estate taxes are paid one year in arrears.

Tangible Personal Property State Tangible Personal Property Taxes

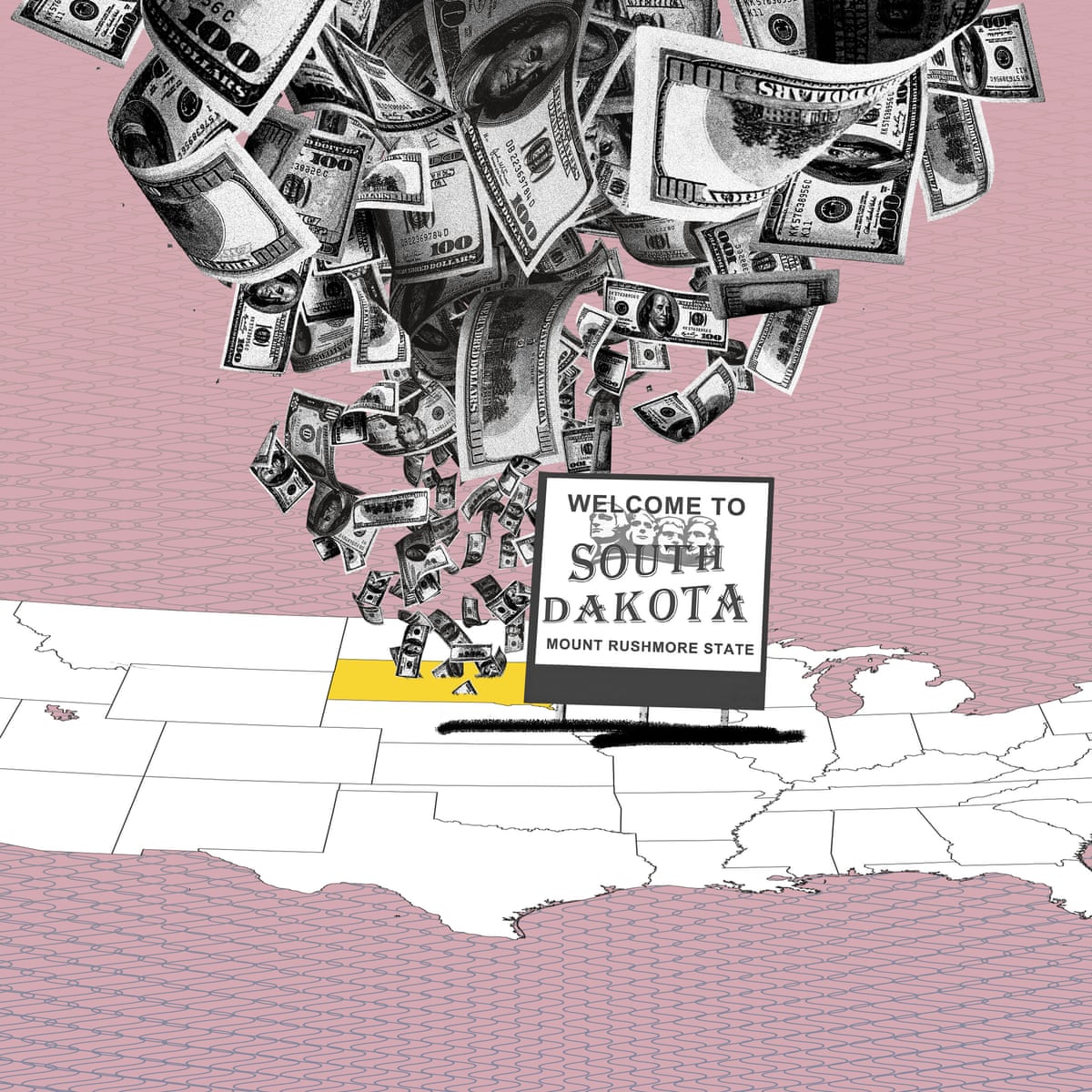

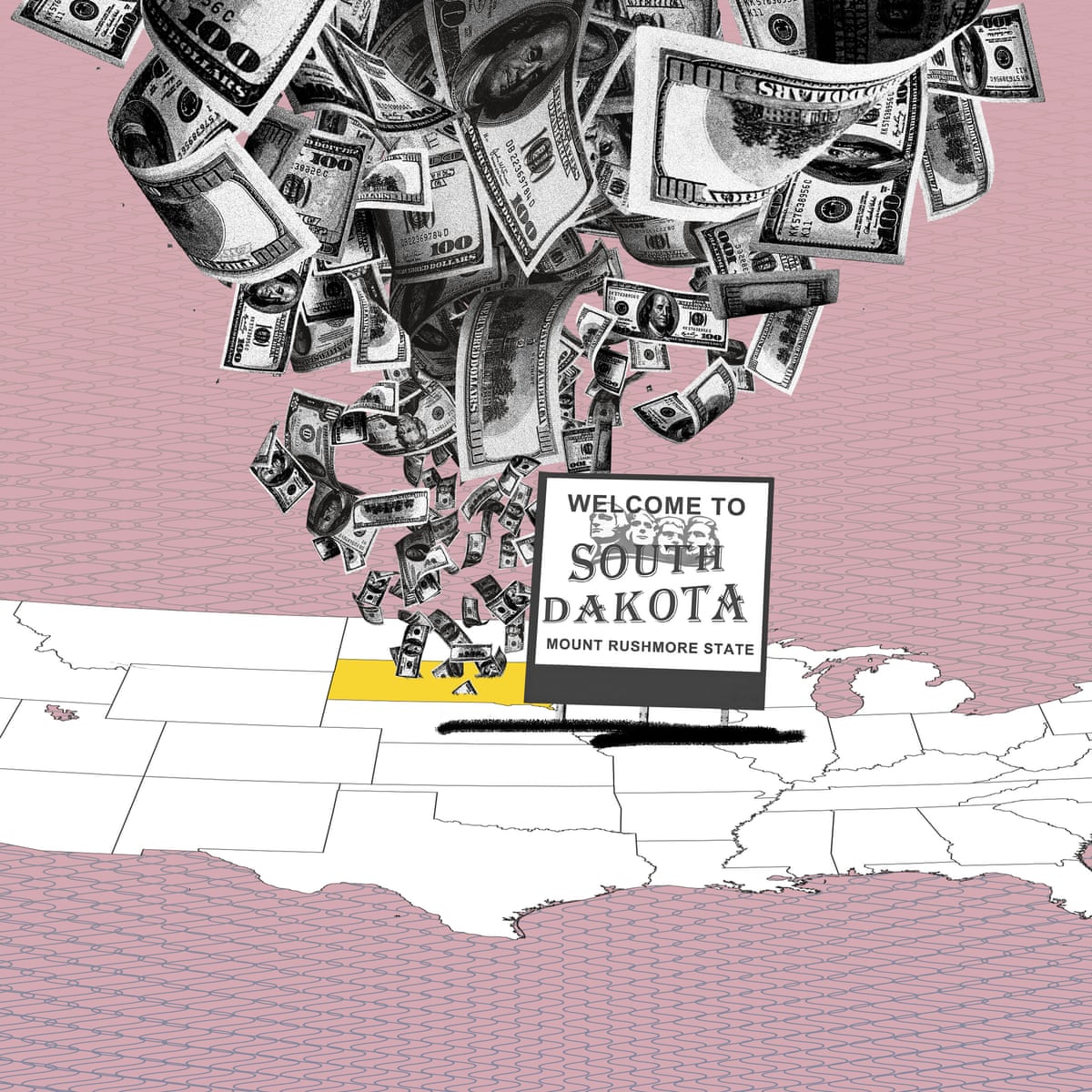

South Dakota Is A Tax Haven But Not The Only One In The U S Verifythis Com

Property Tax Comparison By State How Does Your State Compare

Understanding Your Property Tax Statement Cass County Nd

Equalization Codington County South Dakota

Fall River County South Dakota 906 N River Street Hot Springs Sd 57747

Property Tax South Dakota Department Of Revenue

Equalization Lawrence County Sd

Property Tax Comparison By State For Cross State Businesses

Assessor Hand County South Dakota

U S Tax Havens Lure Wealthy Foreigners And Tainted Money Washington Post

Property Tax Assessment Iowa South Dakota Nebraska

Pandora Papers Reveal South Dakota S Role As 367bn Tax Haven Us News The Guardian

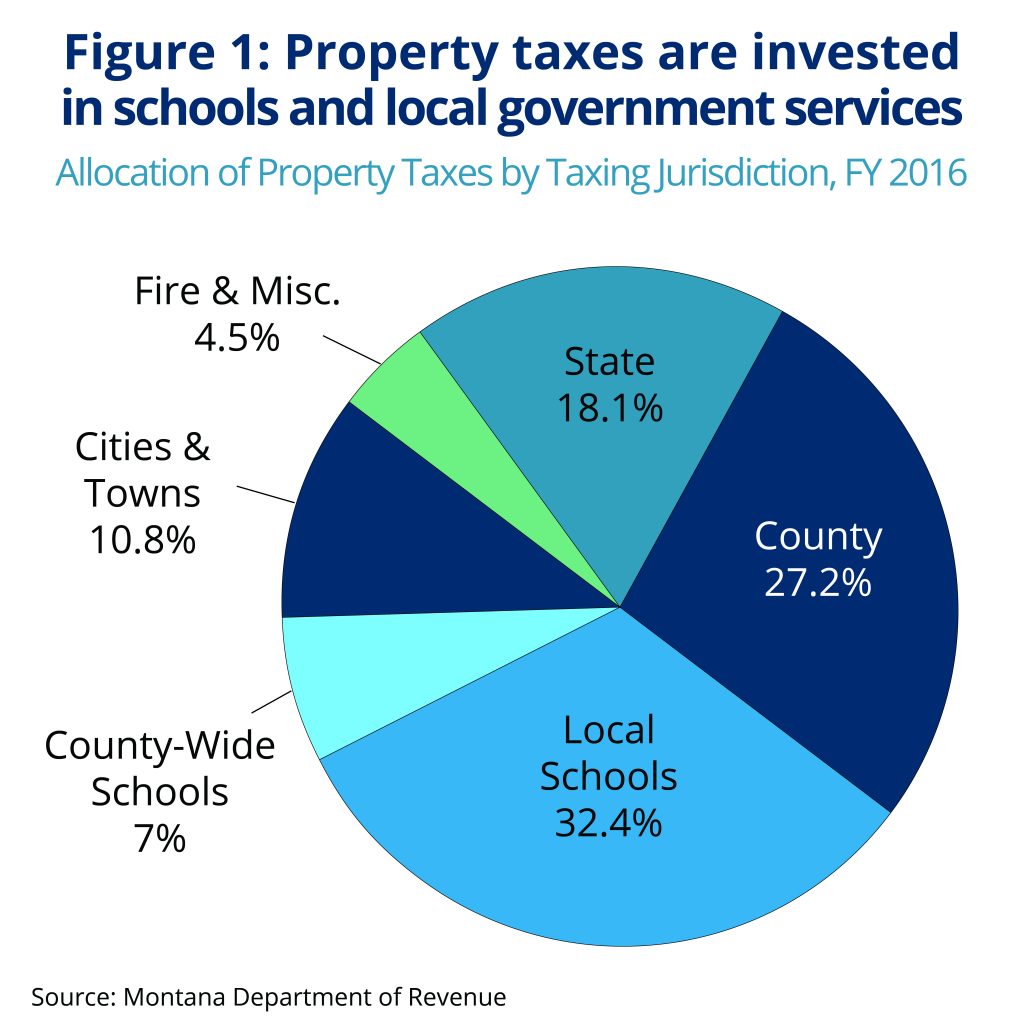

Policy Basics Property Taxes In Montana Montana Budget Policy Center