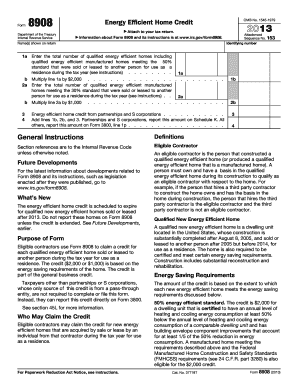

45l tax credit form

Tax Credits Rebates Savings. Routing number for Holyoke Credit Union is a 9 digit bank code used for various bank transactions such as direct deposits electronic payments wire transfers check ordering and many more.

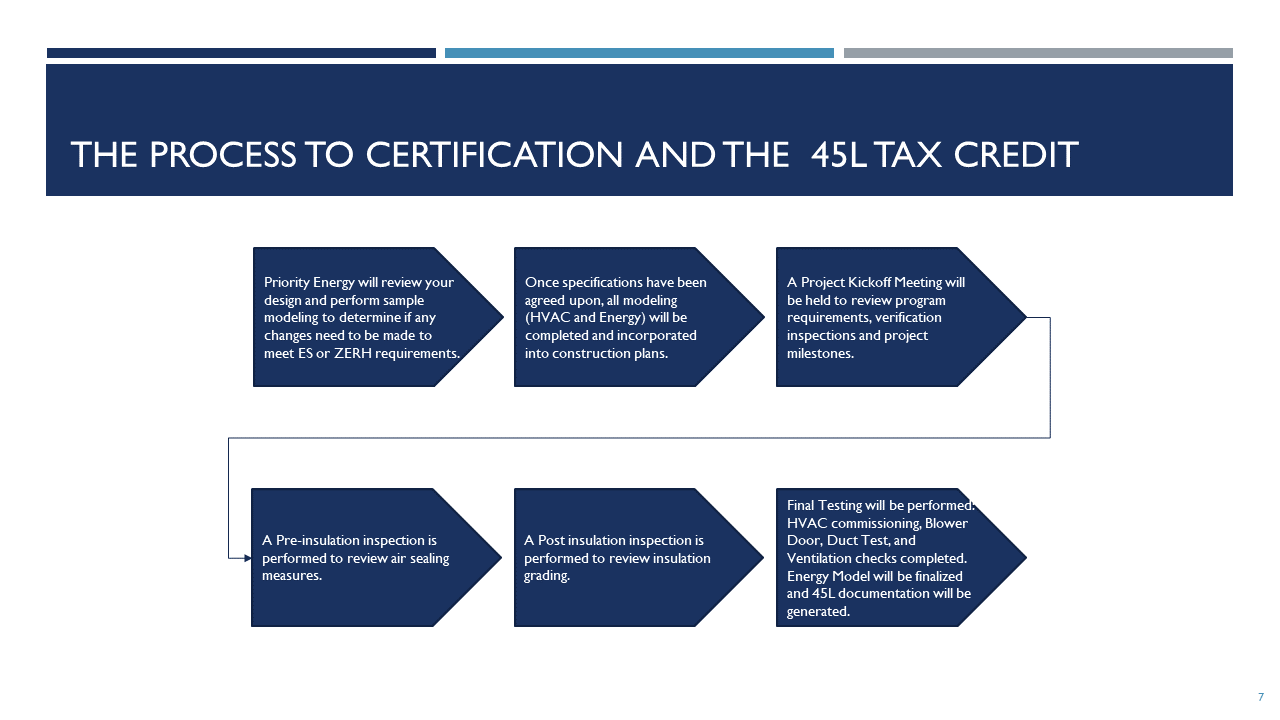

Demystifying The Application Process For The 45l Tax Credit

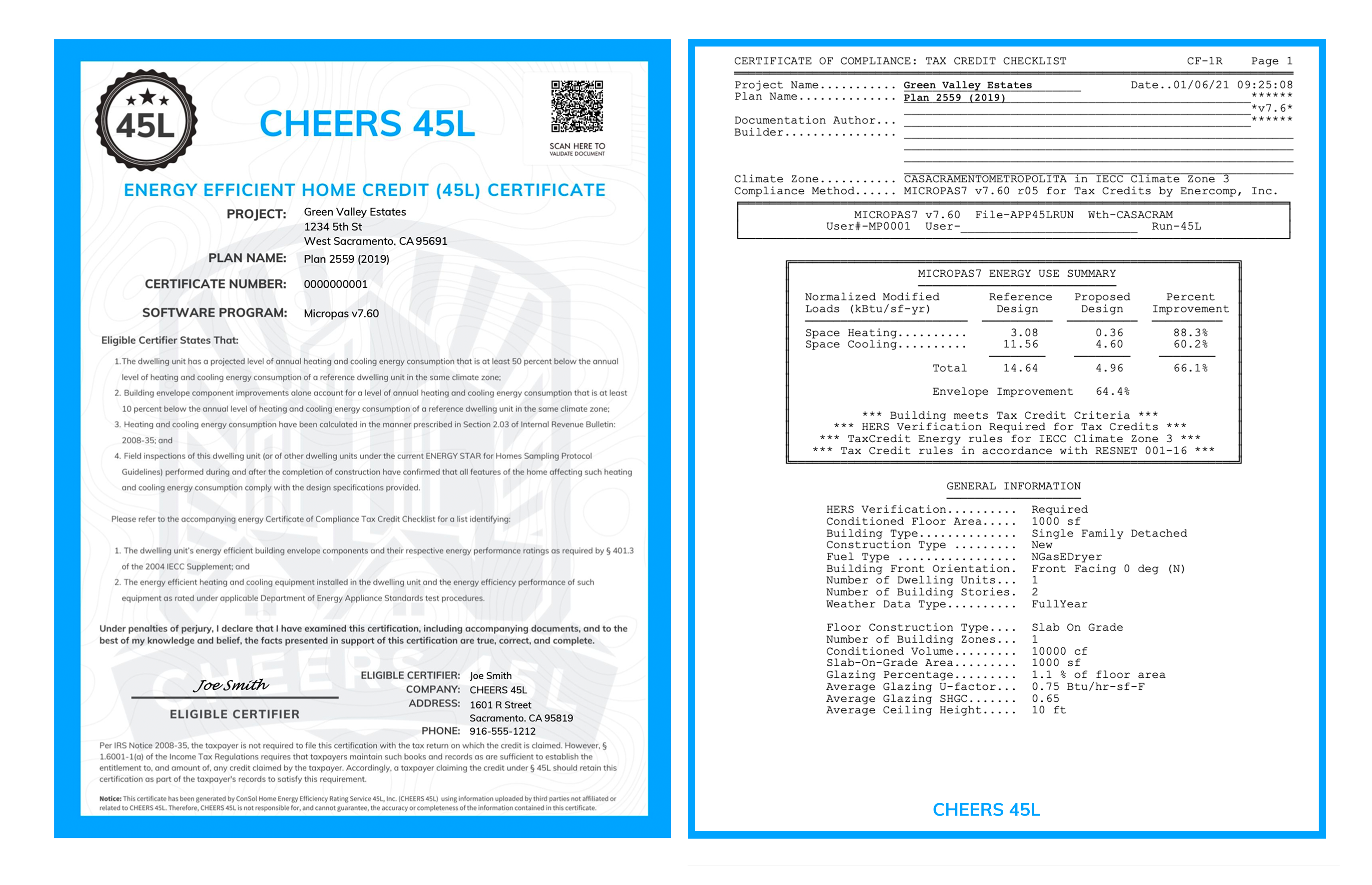

The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient.

. Reduce the expenses incurred in the construction of each new home by the amount of the credit. 2000 each for a total of 70000. Check Out the Latest Info.

Ad 45l tax credit. To learn more about how ETS is. Expenses taken into account for either the rehabilitation credit or energy credit part of the.

The version of the 45L Tax Credit that our industry has leveraged for over 15 years expired on December 31 2021 meaning that there is no active 45L Tax Credit for homes built. Code 45L - New energy efficient home credit. Browse Our Collection and Pick the Best Offers.

Energy credit part of the investment tax credit must not again be considered in determining the energy efficient home credit. Streamlined Document Workflows for Any Industry. Real Estate Change of Address form PDF Motor Vehicle Excise Change of Address Form DOC Motor Vehicle Excise Change of Address Form.

So here are the basic. Change of Address Form. Ad State-specific Legal Forms Form Packages for Government Services.

Ad Register and Subscribe Now to work on FRS Model Form for Credit Score Disclosure Exception. The 45L offers a winwin for those interested in environmentally friendly buildings while having cost savings to reinvest in future projects. Arkansas Home Builder sold 35 homes in 2021 that qualified for 45L tax credits.

Enter total energy efficient home. Acquired by a person from such eligible contractor for use as a residence during the taxable year. Airbnb and other short term rental platforms have begun enforcing Massachusetts occupancy tax laws and a lot of people have been asking us questions.

The credit is available to builders developers and others who build homes for sale or lease. Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal. Use e-Signature Secure Your Files.

Be at least 50 more efficient than. Arkansas Builder received 20000 in credits for homes sold in 2020 and. The Internal Revenue Code IRC Section 45L is a 2000 per dwelling unit 1000 for manufactured homes tax credit for each new energy-efficient home which is constructed by.

Try it for Free Now. Find Forms for Your Industry in Minutes. But you can also claim the 2000 45L Energy-Efficient Home Tax Credit.

To qualify for the 2000 tax credit an eligible dwelling must. A home designed to be energy efficient will fetch a higher price when youre ready to sell it or rent it out. Upload Modify or Create Forms.

45l Energy Efficient Home Credit Ics Tax Llc

One Year Extension Through 2021 For Energy Efficient Home Section 45l Tax Credit Warner Robinson Llc

The 45l Tax Credit For Builders Priority Energy

Form 8908 Energy Efficient Home Credit

45l Tax Credit Services Using Doe Approved Software

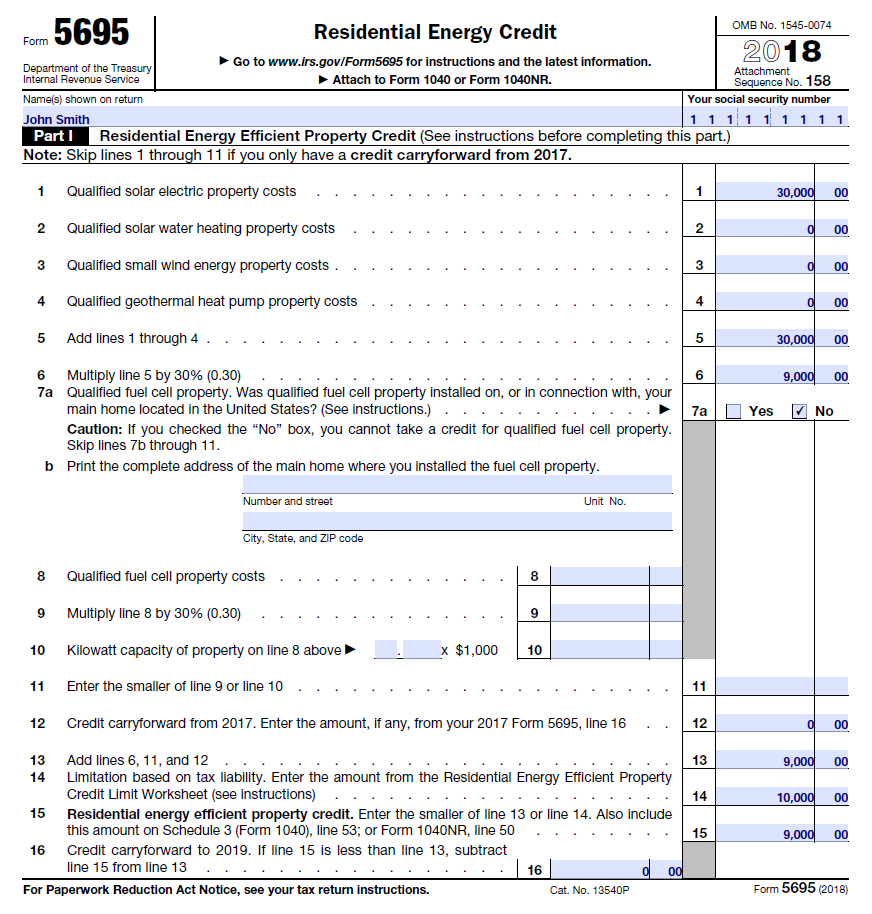

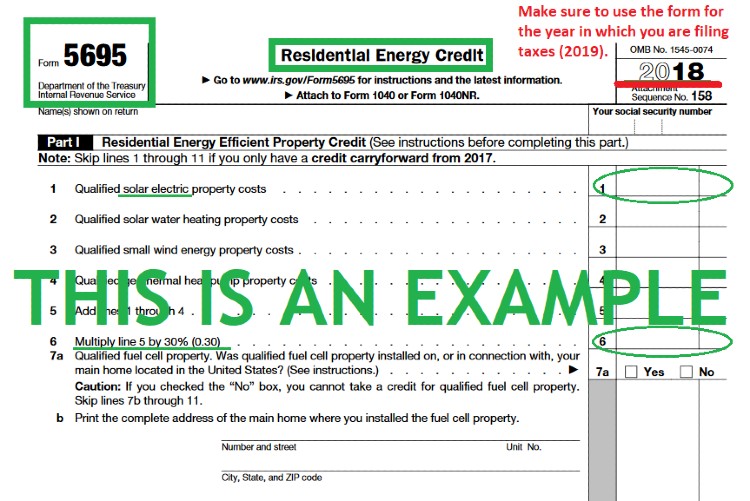

Claiming The Tax Credit About Irs Form 5695 Remodeling

The Federal Solar Investment Tax Credit What It Is How To Claim It

Filing For The Solar Tax Credit Wells Solar

Tax Newsletter March 2021 Basics Beyond

Inflation Reduction Act Impacts Major Changes To 45l Tax Credit 179d Deduction Doeren Mayhew Cpas

What Is The 45l Tax Credit Get 2k Per Dwelling Unit

45l Tax Credit Single Family Guide For More Money Back Southern Energy Management

45l Tax Credit What Is The 45l Tax Credit Who Qualifies

The 2 000 45l Tax Credit What You Need To Know Attainable Home

45l Tax Credit Source Advisors